A Seller's Guide to the Letter of Intent (LOI) to Purchase

- Carson Bomar - Business Broker

- Jul 17

- 11 min read

Updated: Jul 20

A letter of intent to purchase is essentially a formal handshake in writing. For many business owners I’ve worked with, it’s the first tangible sign that a potential sale is getting serious. Think of it as a roadmap: a mostly non-binding document where a buyer lays out the proposed terms of a deal, like price and structure, before anyone sinks serious money into expensive legal work.

For owners who have tried to sell before, the LOI stage is where a deal either gains real momentum or fizzles out. Our approach at Exit Game Plan is to ensure the go-to-market strategy is well-aligned with your goals that by the time you receive an LOI, it’s already a strong fit. This avoids the frustration of mismatched expectations and sets the stage for a successful closing.

Understanding The Role Of An LOI In Your Sale

If you're thinking about selling your business, the Letter of Intent (LOI) is one of the first major milestones you'll encounter. It’s easy to feel nervous about what it means, but don't see it as a scary legal hurdle. View it as a critical tool that brings much-needed clarity and confidence to the process.

Its real power is that it acts as a roadmap for the deal. It gets you and the buyer aligned on the big-picture terms before you commit the time, money, and emotional energy to a deep-dive due diligence process.

Why The LOI Is So Important

A well-crafted LOI is designed to protect you as the seller. It's the moment a buyer formally shows they’re serious by laying out the core terms like price, how you'll get paid, and a proposed timeline. This step alone filters out buyers who aren't truly committed.

We've seen owners get incredibly frustrated when a deal drags on with no clear direction. The LOI solves this. It forces both sides to agree on the most important points right from the start. It's how you separate the truly prepared buyers from those just on a 'fishing expedition.'

This document saves you time and minimizes risk by making sure everyone is on the same page.

It helps you:

Confirm Key Terms Early: You lock in the purchase price, deal structure, and other major conditions before going any further, giving you peace of mind.

Gauge Buyer Seriousness: A buyer willing to put a detailed offer in writing is far more committed than one who only wants to talk.

Set a Clear Path Forward: The LOI outlines the schedule for due diligence and closing, creating a shared timeline that keeps the deal moving.

Ultimately, understanding the LOI’s role is a huge part of maximizing your company's value during a sale. It’s the first real step toward taking control of your exit and moving forward with a solid plan.

Anatomy of an LOI: What Really Matters

When a letter of intent to purchase lands on your desk, your eyes will naturally jump to the purchase price. It’s the headline number, the one you’ve been working toward.

But the real story, the one that determines how much cash you’ll actually walk away with, is woven into the other clauses. I’ve seen it time and time again: sellers get dazzled by a big number, only to find out later that a huge chunk of it is tied to an earnout with unrealistic performance goals. Understanding the complete anatomy of an LOI is the only way to protect the value you've spent years building.

Beyond the Headline Price

The total purchase price is just a starting point. How that price is paid is what truly matters for your financial future. A typical letter of intent will break this down, and you have to scrutinize each component to understand your risk and potential return.

Cash at Close: This is the most straightforward part, the guaranteed money you receive the day the deal is finalized. It’s clean, simple, and in your bank account.

Seller Note: This is essentially a loan you extend to the buyer. You receive payments over time with interest. While it shows you have “skin in the game,” it carries the risk that the buyer might default.

Earnout: This is a conditional payment tied to the business's future performance after you’ve sold it. It can be a way to bridge a valuation gap, but it's also the riskiest component for you as the seller, as you have little control over the outcome.

A Real-World Example: We worked with a seller who was excited to accept an LOI at a headline price that looked great, until we dug into the details. The buyer’s LOI proposed 70% cash at close, but buried the remaining 30% as an earnout based on unrealistic growth targets. Without guidance, the seller might have signed and been stuck chasing unattainable numbers. We helped renegotiate the LOI into a more balanced structure with guaranteed payments and achievable benchmarks. The lesson? Don’t just look at the price, understand the terms.

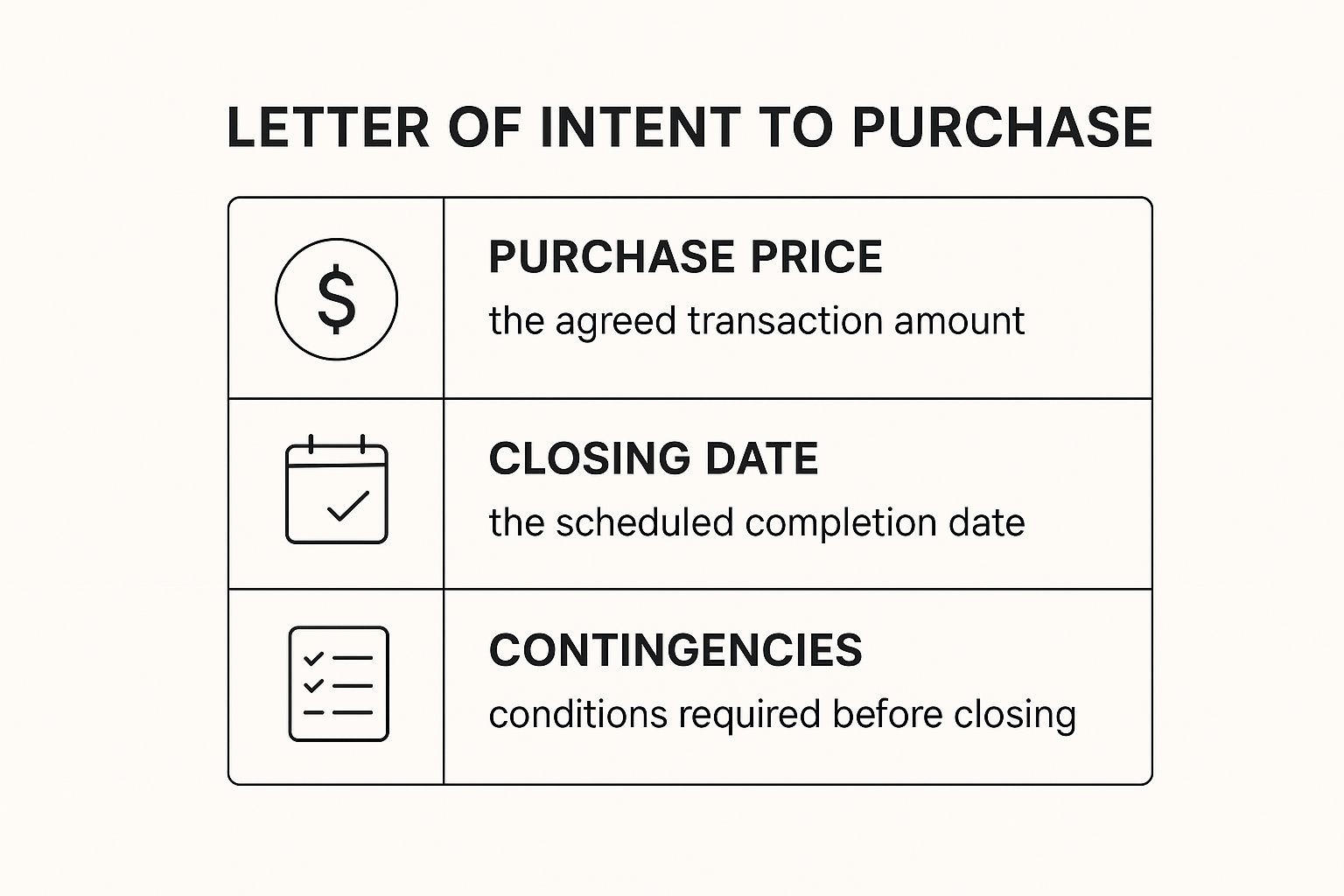

This graphic breaks down the most common high-level terms you'll encounter.

While the price, closing date, and contingencies are the pillars of any deal, the true strength of your position lies in how these elements are defined and connected.

Key Clauses That Define the Deal

Beyond the payment structure, a few other sections shape the entire transaction. In the M&A world, these terms establish the framework for everything that follows, from due diligence to the final purchase agreement. If you want to get even more granular, you can explore insights on LOI key clauses to see what's trending.

To help you get a handle on what you're looking at, here's a quick table translating some of the most common—and critical—LOI terms from a seller's perspective.

Decoding Your LOI Terms

Thinking through each of these points isn't about playing defense; it's about proactively shaping a deal that works for you and provides peace of mind. A great headline price with weak terms can quickly turn into a disappointing exit.

The Critical Importance of the Exclusivity Clause

While most of a letter of intent to purchase is a non-binding roadmap, there’s one section that almost always carries legal teeth: the exclusivity clause, often called a "no-shop" agreement. This clause can dramatically shift your leverage as a seller.

When you agree to this, you’re making a binding promise to shut down all talks with other potential buyers for a set amount of time. The buyer is essentially asking you to take your business completely off the market, just for them. It’s a huge bargaining chip to give away.

This commitment is exactly why we advise owners to never grant exclusivity until they have a credible, written LOI with terms they find acceptable. Think of it as a trade: you give them exclusive focus in exchange for their serious, documented offer.

A Cautionary Tale about Exclusivity

In one recent deal for a beauty brand, we had a buyer who insisted on exclusivity before even submitting an offer. Against our better judgment, the seller allowed it, and we spent weeks providing detailed due diligence materials. The buyer then came back with a lowball offer, having already tied up the business and discouraged other buyers.

The lesson learned is crystal clear: exclusivity is a powerful commitment, and sellers should only agree to it once they have a credible, written LOI with meaningful terms. Never give exclusivity without an offer, it removes your leverage and gives the buyer all the power.

What Is a Reasonable Exclusivity Period?

So, what's a fair timeline? The goal of the exclusivity period is to give the buyer enough time to conduct focused due diligence without being rushed — but not so long that your business is sidelined indefinitely if the deal goes south.

For most businesses in the $1M to $20M range, we recommend starting with a 30-day exclusivity period. That’s generally ample time for a serious buyer to dive into financial, legal, and operational reviews, demonstrate their intent, and decide if they truly want to move forward. It also creates a healthy sense of urgency, keeping the buyer engaged and moving the process forward.

If, during those 30 days, the buyer is showing forward-moving intent and making steady progress, the exclusivity can always be extended. But starting longer — say, 60 or even 120 days — risks giving away negotiating leverage and locking you up with a buyer who may not be as committed as you’d hope.

Red Flags to Spot in Any Letter of Intent

Anything longer than 30–60 days should be met with healthy skepticism. A buyer pushing for 120 days or more might be signaling a lack of urgency, or worse, trying to lock you up while they explore other options. Remember, the no-shop clause is one of the very few binding parts of the letter of intent to purchase. Treat it with the strategic importance it deserves to protect your negotiating position.

Vague or Overly Complex Deal Structures

One of the most glaring red flags is an LOI that’s fuzzy on the core economics. If a buyer can't clearly state the purchase price structure, how much cash at close, the terms of any seller note, and exactly how an earnout will work, they either haven't done their homework or they're leaving things vague on purpose so they can renegotiate later.

You should be immediately skeptical of:

Undefined Earnout Metrics: An LOI that just says “an earnout will be included” without defining even the broad performance framework is a problem. This just kicks the can down the road on what is often the most contentious part of the entire negotiation. While it’s true that buyers can’t fully define every metric without due diligence, they should at least spell out the intended structure, for example, revenue-based vs. EBITDA-based, and the period over which it applies.

Unspecified Working Capital Targets: This is another classic tactic. Buyers often include language referencing a “normalized level of working capital” but conveniently leave out what that number is. Without clarity, they can come back right before closing demanding more cash or inventory to meet a target you didn’t agree to.

That said, it’s worth noting that some flexibility here is normal at the LOI stage. Working capital calculations, and even detailed earnout mechanics, almost always require a deeper dive into your books. The key is to at least get the framework and intent into the LOI. For example:

“Earnout to be based on EBITDA performance over a 24-month period, with specific thresholds to be finalized during due diligence.”

And remember: inventory is typically treated as part of working capital, or sometimes as a seller-side injection, and those details are best worked out once the buyer has fully reviewed your operations.

Fishing Expeditions and Endless Due Diligence

A serious buyer comes to the table with a plan. They know what information they need to verify and have a realistic idea of how long that should take. A buyer who is just "fishing" for problems, on the other hand, will often propose an unusually long due diligence period.

I’ve seen buyers use an LOI to tie up a business for four to six months, only to walk away or aggressively re-trade the price after finding a minor, insignificant issue. A typical due diligence period should be 30 to 60 days. Anything longer needs a very good explanation.

A clear letter of intent is critical because it forces the buyer to put their intentions in writing, with specific timelines and boundaries. Without that clarity, you risk wasting months on a buyer who was never serious to begin with.

High-Pressure Tactics and Excessive Contingencies

Finally, be wary of any buyer who pressures you to sign an LOI on the spot without giving you time to have your advisors review it. A professional buyer expects you'll seek expert guidance; they know it’s part of a healthy, transparent process.

Also, scan the LOI for an excessive number of “subject to” clauses. While some contingencies are standard, like securing financing, an LOI riddled with them gives the buyer endless ways to back out. A confident buyer who has done their homework will present a clean offer with minimal, well-defined conditions.

Negotiating Your LOI for a Better Outcome

Successfully negotiating a letter of intent to purchase is a balancing act. You need to lock in the critical economic terms that protect the value you've built. At the same time, getting bogged down in minor details too early can create friction and kill a deal's momentum.

The goal is to agree on the big picture, not to hash out every last word of the final, binding contract.

We’ve seen buyers use LOIs in different ways, some try to keep them vague so they can renegotiate later, while others try to lock the seller into overly rigid terms before they’ve even done due diligence. A balanced LOI strikes the right tone: clear on key economic terms and contingencies, but flexible enough to adapt as facts come to light. We coach sellers through this balancing act on every deal we work on.

Keep Certain Terms Intentionally Flexible

This might sound counterintuitive, but one of the most effective strategies is to keep certain non-economic terms intentionally flexible at the LOI stage. This prevents arguments over issues that no one has enough information to solve yet.

In my experience, we advise keeping the LOI as loose as possible in certain areas, especially around post-closing transition and training. Why? Because the buyer doesn’t yet know how the business really runs until they’re deep into due diligence. If you try to lock in overly specific training terms at the LOI stage, you’re either guessing or creating unnecessary friction. The right time to negotiate those details is after due diligence, when everyone understands what you actually do day-to-day and what the buyer truly needs post-closing.

Knowing When to Bring in Your Attorney

Another question we get all the time is, "Should my lawyer review the LOI?" While legal advice is critical before signing any binding contract, at the LOI stage it can sometimes muddy the waters.

Remember, the key business terms of an LOI are generally non-binding. If the buyer walks away after due diligence, you’ve spent thousands on legal fees for nothing.

We often see sellers rush to bring in an attorney at the LOI stage. Instead, we recommend letting your broker guide the LOI negotiation, making sure you understand the key economic and binding terms (like exclusivity), and saving the attorney review for the final purchase agreement. It keeps the process moving and avoids unnecessary expense or conflict at an early stage.

Once the LOI is signed and you’re moving on to the definitive purchase agreement, the actual, legally binding contract, that’s the perfect time for your attorney to step in. It’s all about using your experts at the right stage. For a deeper dive into the numbers that drive these discussions, check out our guide on **how to value a business for a successful sale**.

What Happens After the LOI Is Signed

Getting the letter of intent to purchase signed is a huge moment. Most owners I work with breathe a massive sigh of relief, it's a major milestone that confirms you have a serious buyer. But it's not the finish line. In reality, it’s the starting gun for the most intense phase of the process: due diligence.

This is where the real work begins. The signed LOI gives the buyer the green light to invest serious time and money into verifying every single piece of your business.

The Deep Dive of Due Diligence

Once the ink is dry, you officially enter the exclusivity period. The buyer's team will begin a deep dive, scrutinizing your financials, combing through customer contracts, and verifying operational procedures. Your job is to be an organized and responsive facilitator, providing everything they ask for as quickly as possible.

You can expect requests for:

Detailed financial statements and tax returns for the past several years.

Copies of your key customer and supplier agreements.

A full rundown of employee records and compensation details.

All your corporate records and any important legal documents.

This stage is all about verification. The buyer is confirming that the business is what you represented it to be. The best thing you can do to keep the deal moving forward is to be prepared, organized, and responsive.

Drafting the Definitive Agreement

While the buyer's accountants and consultants are digging through your data, the lawyers get to work. Their mission is to translate the framework you agreed to in the non-binding LOI into a formal, legally binding contract. This is usually called the Definitive Purchase Agreement (DPA) or an Asset Purchase Agreement (APA).

This is where every detail you negotiated, price, structure, your representations and warranties, gets hammered out in dense legal language. This is the master document for the entire transaction.

A Word of Advice: I've seen it time and time again, the period between the LOI and closing can feel like it drags on forever. It’s demanding. Manage your own expectations and stay focused. The buyer is looking for reasons to feel confident, and your professionalism at this stage speaks volumes.

The LOI is a powerful signal that you have a serious buyer and a solid deal structure. Getting from that signature to the closing table means navigating these final, crucial steps with the same strategic focus. For online business owners, this phase has its own unique hurdles, and we’ve put together some specific advice on **navigating the sale of eCommerce businesses**.

Having a trusted advisor in your corner to guide you through this final stretch is absolutely crucial for your peace of mind, and for getting the best possible outcome.

Avoiding the pitfalls in a Letter of Intent can be the difference between a disappointing process and a life-changing exit. If you’re thinking about selling, the team of Carson Bomar & Matt Perkins at Exit Game Plan is here to help you plan the right way—confidentially and at your pace. Contact us today to start planning your successful exit.