How to Value a Business for a Successful Sale

- Carson Bomar - Business Broker

- Jul 16, 2025

- 16 min read

Updated: Jul 17, 2025

If you're thinking about selling your business, there's one question that trumps all others: "What's it actually worth?"

A real-world valuation isn't what some online calculator spits out. It’s a carefully considered blend of hard numbers, current market realities, and what a serious, qualified buyer is truly willing to pay. This is the process that uncovers the real value of everything you've poured into your company.

What Is Your Business Really Worth?

That single question is almost always the first step toward the biggest financial event of an business owner's life. Getting the answer right lays the groundwork for a successful exit. Getting it wrong? That's a recipe for frustration, wasted months, and leaving a significant amount of money on the table.

For you, the owner who has put in the years, the sweat, and the capital to build something profitable, this isn't just some academic exercise. It's deeply personal.

Moving Beyond a Simple Number

A proper valuation is so much more than a final number printed on a report. Think of it as a strategic tool that tells the story of your business from a buyer's point of view. It shines a light on the strengths you'll lean on during negotiations and, just as importantly, exposes the weaknesses you might want to fix before you go to market.

Time and again, we talk to owners whose first attempt to sell fell through. The number one reason is almost always the same: a massive gap between what they thought their business was worth and what the market was actually willing to offer. It's a painful, and completely avoidable, scenario.

Our approach is different. We believe in aligning on a realistic go-to-market strategy before a single buyer is ever contacted. If we can’t agree on a plan that matches your goals with market realities, we’d rather part ways as friends than set you up for disappointment.

This guide is designed to pull back the curtain on how to value a business. We're going to skip the dense, theoretical jargon and get straight to the practical insights that matter for companies in the $1 million to $100 million revenue range.

We'll walk through the core components of a valuation that can stand up to scrutiny, including:

The Methods: Getting to know the "three-legged stool" of valuation that every serious buyer uses.

The Adjustments: How to calculate your true profitability (hint: it's probably higher than you think).

The Multiples: We'll look at where these crucial numbers come from and why they can vary so dramatically.

The "Softer" Factors: Digging into the intangible assets that can seriously drive up your final price.

Our goal here is to give you clarity and confidence. When you truly understand what your business is worth, you can walk into the sale process empowered, prepared, and positioned for the successful exit you've earned.

The Three Core Business Valuation Methods

When you sit down to talk seriously about what your business is worth, the conversation will always come back to three core methods. I like to think of them as a three-legged stool. For a valuation to be stable and credible, it needs to stand on all three legs, even if one carries more weight than the others.

Getting a handle on these approaches is crucial because it’s how you start to see your business through a buyer’s eyes. They aren’t just pulling a number from thin air; they're using these established frameworks to build a logical case for a specific price. Triangulating the value this way leads to a defensible number they can confidently take to their partners or to a lender like the SBA.

The Income Approach: Where Profit Is King

For any profitable company, the Income Approach is, by far, the most important piece of the puzzle. At the end of the day, buyers aren't just buying your past performance, they're buying the future profits your business is set to generate. This approach measures that potential directly.

The most common tool we use here for small-to-mid-sized businesses is the Seller’s Discretionary Earnings (SDE) Multiple. We’ll get into the nitty-gritty of calculating SDE later, but it’s basically the total financial benefit an owner-operator gets from the business. For larger, more complex companies with strong management teams, buyers may instead look at EBITDA multiples, which adjust for owner salary and other discretionary expenses.

This method is the go-to valuation approach for most profitable service businesses, e-commerce brands, SaaS companies, and digital agencies, essentially any business with consistent cash flow and room for growth. What buyers care about here is simple: your company’s ability to reliably generate cash and deliver a return on their investment.

The Market Approach: A Reality Check

Think of the Market Approach like running "comps" in real estate. It's a powerful reality check that compares your business to similar ones that have recently sold. This is where having an advisor with access to private deal databases becomes a massive advantage.

We can pull data on businesses in your industry, of a similar size, that have sold in the last 12-24 months. These comps reveal a range of valuation multiples (for instance, 3.5x to 4.5x SDE) that the market is actually paying. It grounds the valuation in reality, so you don't set an asking price that scares off every serious buyer from the get-go.

A Quick Anecdote: We once worked with a software company founder who was convinced his business was worth 10x its earnings after reading about a massive public company sale. By showing him direct comps of five similar private SaaS companies that sold for 5-6x earnings, we reset expectations. We priced it right, attracted multiple serious offers, and closed a deal that truly met his financial goals.

This method answers the simple, vital question: "What are people actually paying for a business like mine right now?" It's a dose of reality that's essential for any successful sale. We walk through this process in more detail in our guide to professional **business valuation services**.

The Asset-Based Approach: The Foundation

Last, we have the Asset-Based Approach. It’s the most straightforward method but often the least relevant for a healthy, profitable business. It's a simple calculation: what would it cost to rebuild the business from scratch? You just add up the fair market value of all the assets (equipment, inventory, property) and subtract the liabilities.

When it's most relevant: This approach takes the lead for asset-heavy businesses like trucking or heavy manufacturing. Unfortunately, it also becomes the primary method for businesses that aren't profitable. For a company losing money, its value might just be what its assets can be sold for.

For a thriving business, the Asset Approach typically just sets the value "floor." A buyer knows they are at least getting those assets, but the real value they're after is the earning power, the value proven by the Income Approach and validated by the Market Approach. A professional valuation expertly blends all three to paint the full, accurate picture.

Looking Beyond the Numbers: What Buyers Really Want

The financial statements and valuation formulas we've covered are the bedrock of your business's worth. They give you a number. But the most serious buyers—think private equity groups, strategic competitors, and sharp search funders, are just as focused on the why and the how.

They aren't just buying your past performance; they're buying future potential. And, more importantly, they're trying to de-risk their investment. This is where the real art of business valuation comes in. These qualitative factors, which we call Value Drivers, can have a huge impact on your final sale price. It’s not uncommon to see them add a full turn or more to your valuation multiple.

The numbers get you a seat at the table. These strengths are what let you walk away a winner.

Diagnosing Your Business Through a Buyer's Eyes

Every business has a story, and a smart buyer is reading between the lines of your P&L to figure it out. They’re searching for signs of a strong, durable operation that promises a smooth handover and future growth. At the same time, they are on the hunt for red flags that scream "headache ahead!"

Many owners we work with are shocked by what buyers really dig into. It’s almost never about the nice office furniture or the company’s founding story. It’s about the underlying systems and dependencies that prove your cash flow can stand on its own two feet. You can get a much deeper look into this by **understanding how a buyer will see your company**.

Here are a few of the most critical areas a buyer will put under a microscope:

Owner Dependence: Can the business run without you? If you're the lead salesperson, the keeper of all key client relationships, and the only one who knows how things really get done, you don't have a business to sell, you have a high-stress job.

Management Team Strength: A solid, experienced management team that can operate independently is one of the most powerful value drivers you can have. It tells a buyer the company won’t fall apart the day you hand over the keys.

Customer Concentration: Is more than 15-20% of your revenue tied up with a single customer? That’s a massive red flag. Losing that one client could cripple the business overnight. A diverse, loyal customer base is a sign of health and stability.

Recurring Revenue: Predictable, contracted revenue is gold. Whether it’s from software subscriptions, long-term service contracts, or monthly retainers, recurring revenue is far more valuable than one-off project work because it removes a huge amount of uncertainty for the buyer.

A Quick Anecdote: We once advised a marketing agency owner whose business was almost entirely project-based. Over two years, we helped him pivot his model to focus on long-term retainers. When he finally sold, his valuation multiple was nearly 50% higher than it would have been otherwise. Why? Because the revenue was predictable and far less risky for the new owner.

Building a Defensible Moat Around Your Business

Beyond the day-to-day operations, buyers are looking for what makes your business special and hard to copy. This competitive "moat" protects you from the competition and can significantly boost what a buyer is willing to pay.

Ask yourself: what makes my business tough for someone else to replicate?

Documented Processes: Could a new owner walk in tomorrow, follow your Standard Operating Procedures (SOPs), and understand how to run the show? We’ve seen deals where clean, well-documented processes added millions to the final price simply because they slash operational risk.

Proprietary Technology or IP: Do you own patents, trademarks, or unique software that gives you a leg up? This kind of intellectual property can be an incredibly valuable, standalone asset.

Supplier & Employee Stability: High employee turnover or a heavy reliance on a single supplier can be seen as major risks. On the flip side, a stable, happy team and a diversified supply chain signal a well-managed, resilient company.

By taking an honest look at these qualitative factors now, you give yourself a powerful head start. You can spot the weaknesses and turn them into strengths long before you even think about selling, transforming potential deal-breakers into compelling reasons for a buyer to pay a premium.

Calculating Your True Profitability with SDE and EBITDA

When a buyer sits down to look at your business, their focus narrows to a single, critical question: what is its real cash-generating power? Frankly, they aren't concerned with the net income figure you filed on your tax return. What they're buying is the potential for future profit, and the two most powerful metrics for revealing that truth are Seller's Discretionary Earnings (SDE) and EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization).

Getting a firm grip on these numbers is non-negotiable. They form the bedrock of almost every private business valuation. When you calculate them correctly, you transform a standard, tax-focused financial statement into a compelling story of profitability—a story that a buyer can understand, trust, and ultimately, pay a premium for.

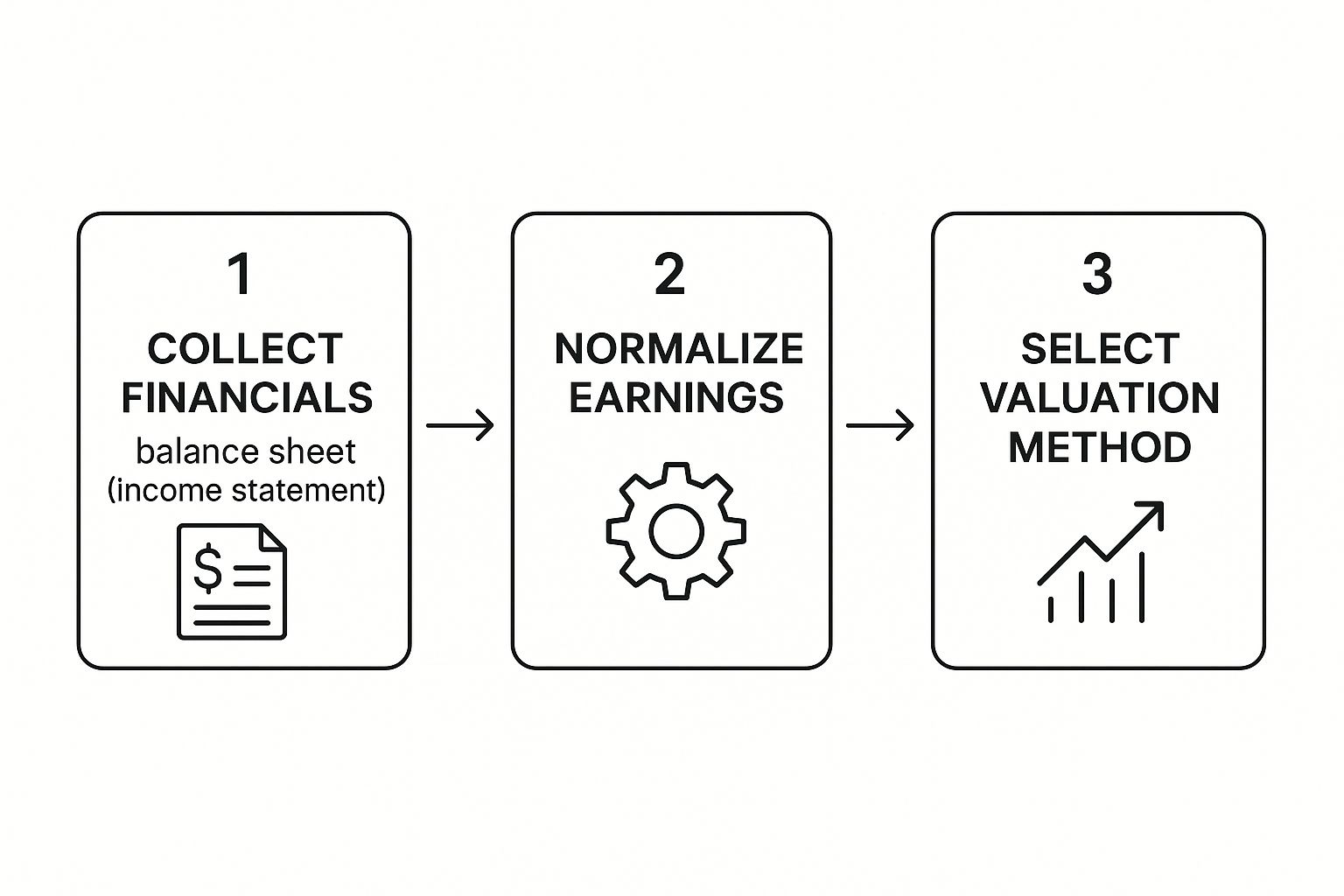

The whole point is to "normalize" your income statement. We're essentially showing what the business's earnings would look like for a new owner. This process is often an eye-opener for sellers, revealing a level of profitability they never fully appreciated.

This is a critical step that connects your raw financial data to the valuation methods buyers will actually use.

As you can see, normalizing your earnings is the bridge between your books and your final valuation.

The Power of "Add-Backs" in Normalizing Your Earnings

The secret to normalizing your financials lies in identifying and justifying "add-backs." Think of these as expenses you, the current owner, run through the business that a new owner wouldn't have to. They represent cash flow that truly belongs to the owner's benefit but is otherwise hidden on a standard profit and loss statement.

We've walked hundreds of owners through this, and it’s almost always the moment the lightbulb goes on. So many come to us, frustrated after a previous attempt to sell, because their advisor never dug deep enough to find these crucial adjustments. A properly calculated SDE can dramatically boost your business's perceived value.

Some of the most common add-backs we see include:

Owner's Salary & Benefits: We add back your compensation and any related payroll taxes. The new owner will set their own salary.

Personal Expenses: That family cell phone plan, the lease on a car used mostly for personal trips, or the "business" trip that felt more like a vacation. These are legitimate add-backs.

One-Time or Non-Recurring Expenses: Did you have a major, one-off legal settlement last year? Or maybe you paid for a complete office renovation? These aren't part of normal operations and should be added back to your profit.

Charitable Donations: While admirable, these are discretionary choices, not operational necessities.

Salaries for Non-Working Family Members: If you're paying a relative who isn't contributing directly to the business, that salary is a clear add-back.

Crucial Insight: Documentation is everything. You can't just throw numbers on a spreadsheet; you need to prove every single add-back with clean records. A buyer's due diligence team will scrutinize these adjustments, and well-organized financials build the trust you need to get a deal over the finish line.

A Practical Example of an SDE Calculation

Let's make this real. Imagine you own a successful marketing agency with $5 million in annual revenue.

Your income statement shows a Net Profit of $250,000. On paper, that’s what the business made. But now, let's find the real number, the SDE.

The table below breaks down how we take that net profit and add back the owner-related and non-recurring expenses to find the true cash flow.

Example SDE Calculation for a $5M Revenue Business

Financial Item | Amount | Explanation |

|---|---|---|

Net Profit (from P&L) | $250,000 | This is our starting point from the income statement. |

Add-Back: Owner's Salary | $150,000 | Your W-2 salary. |

Add-Back: Owner's Health Insurance | $20,000 | Company-paid premium for you and your family. |

Add-Back: Company Car Lease | $12,000 | A vehicle primarily used for personal travel. |

Add-Back: One-Time Legal Fees | $40,000 | From a settled trademark dispute that won't recur. |

Add-Back: Interest Expense | $25,000 | From a line of credit a new owner would replace. |

Add-Back: Depreciation | $30,000 | A non-cash expense from accounting rules. |

Seller's Discretionary Earnings (SDE) | $527,000 | The business's true cash-generating capability. |

Suddenly, a business that looked like it was making $250,000 is correctly shown to be generating over half a million dollars in benefit to the owner. This $527,000 figure is what a buyer will use, multiplied by a market-based multiple, to determine your company's value.

This simple but powerful adjustment process is the first, most important step toward understanding what your business is truly worth.

How Market Multiples Shape Your Final Valuation

So you've done the hard work. You've gone through your financials, made the right adjustments, and landed on a clear picture of your true profitability, your SDE or EBITDA. That number is the engine of your valuation.

But it’s only half of the equation.

The other half is the multiple. And honestly, this single number is probably the most debated and misunderstood part of any business sale. We talk to so many owners who come to us frustrated by this exact topic, especially if they've tried to sell before. They see flashy headlines about tech unicorns with sky-high multiples and can't figure out why their business is valued on a completely different scale.

Frankly, this disconnect over the multiple is one of the biggest reasons deals fall through.

The truth is, a multiple isn't just some number pulled out of thin air. It’s a direct reflection of risk and opportunity as seen by the market. Think of it as the market’s shorthand for how durable and attractive your company's future profits are.

What Determines Your Multiple

A multiple is a blend of factors that any serious buyer will dig into. If your SDE or EBITDA is the horsepower of your business, the multiple is the condition of the road ahead. A smooth, predictable, high-growth road naturally commands a much higher multiple than a bumpy, uncertain one.

Here are the key drivers that shape your multiple:

Industry: Let's be real, some industries are just more attractive to buyers. A SaaS company with 80% recurring revenue and juicy margins will always get a higher multiple than a project-based construction firm with inconsistent cash flow.

Size: Generally, bigger is better. A business with $5 million in EBITDA is seen as far more stable and less risky than one with $500,000 in EBITDA. That stability attracts a bigger, more sophisticated pool of buyers who are willing to pay a premium.

Growth Trajectory: Is your business growing, flat, or shrinking? A company that can show consistent, double-digit growth year-over-year is demonstrating massive future potential, and buyers will absolutely pay a premium for that.

Risk Profile: This covers all the "softer" factors we've discussed—things like how much the business depends on you, customer concentration, and the quality of your management team. The lower the perceived risk, the higher the multiple.

Here’s a real-world example: We recently worked with two B2B service companies, and both had roughly $1 million in SDE. Company A was incredibly dependent on the owner for sales and had one client accounting for 40% of its revenue. It ended up selling for a 3.5x multiple. Company B, on the other hand, had a strong second-in-command, a diverse client base, and well-documented processes. It sold for a 5.0x multiple. That’s a $1.5 million difference in value on the exact same earnings.

The Impact of Broader Economic Conditions

Your multiple doesn't exist in a bubble. It's also pushed and pulled by the wider M&A market and the overall economy. Things like interest rates, investor confidence, and even geopolitical events can have a direct impact on a buyer’s appetite for risk and their ability to get financing.

Understanding these external forces is crucial. It helps you set realistic expectations right from the beginning, which is the absolute cornerstone of a successful exit. A grounded, defensible price range that’s backed by what’s actually happening in the market is what gets deals done.

Taking the Next Step Toward a Successful Exit

Getting a professional valuation is so much more than just seeing a number on a page. Think of it as a strategic roadmap for what is likely the most significant financial decision of your life. It gives you the clear, unbiased insight you need to confidently decide if now is truly the right time to sell.

Even more importantly, it pinpoints exactly what you need to improve to maximize your company's value for a future exit. For so many owners I've worked with, this process is what turns the vague, emotional question of "what if?" into a concrete, actionable plan for "what's next."

From Guesswork to Game Plan

An informal guess or a number spit out by an online calculator just won't cut it when you're sitting across the negotiating table. A formal valuation process, on the other hand, arms you with objective data. It gives you the leverage to defend your asking price and ensures you don’t leave your legacy, and your hard-earned money—to chance.

This is especially true for owners who have tried to sell before and felt the deep frustration of misaligned expectations. A realistic, data-backed valuation grounds the entire process, building the confidence and peace of mind you need for a smooth transaction. You can dive deeper into some specific strategies for maximizing the value of your business here.

A valuation isn't an obligation to sell. It's an investment in clarity. It gives you the power to make the right decision for you, your family, and your employees, on your own timeline.

If you’re ready to understand the true potential of your business and build a realistic plan for the future, we’re here to help. We can provide a confidential, no-pressure valuation that finally gives you the clarity you need to move forward.

Contact Exit Game Plan today for a confidential conversation about your business.

Common Questions About Valuing a Business

When you're thinking about how to value a business, especially your own, a lot of questions come to mind. It’s a process filled with technical terms and, let's be honest, high stakes. We get it. Here are some direct, no-nonsense answers to the most common questions we hear from business owners just like you.

How Long Does a Formal Valuation Take?

A professional business valuation isn’t something you can get overnight — and you should be wary of anyone who claims otherwise. That said, if you’re organized and can provide all the necessary financials and supporting information upfront, we can typically deliver a thorough, defensible valuation in just 3 to 5 business days. The key is having everything ready to go when we start.

Why not overnight? A proper valuation still requires a deep dive into your company’s performance, it’s not something that can be cranked out in a few hours. Our process includes a thorough analysis of your financial documents, research into market comparables, and important conversations with you to understand the qualitative factors, the real story behind the numbers. The biggest factor affecting the timeline is how quickly you can provide clean, organized financial records. When everything is ready up front, we can typically complete our analysis within just a few business days.

Will Getting a Valuation Force Me to Sell?

Absolutely not. This is one of the biggest misconceptions we see, and it holds too many owners back from taking this critical first step.

Think of a valuation as a strategic planning tool, not a commitment to sell. It provides you with objective, data-driven information so you can make an informed decision. The power remains entirely in your hands.

In fact, many of the savviest owners we work with get a valuation one to three years before their target exit date. This gives them a clear roadmap of what to improve to maximize their sale price when the time is right.

What Documents Will I Need to Provide?

To build a credible and defensible valuation, we need to look at your company's historical and current performance. It’s best to start gathering these items early on.

Be prepared to provide the following:

Financial Statements: We'll typically need the last three to five years of your Profit & Loss (P&L) statements and Balance Sheets.

Tax Returns: The corresponding business tax returns for that same three-to-five-year period are also essential.

Interim Financials: To see how you're doing right now, we'll need a current, year-to-date P&L and Balance Sheet.

Add-Back Schedule: This is a key document—a detailed list of all discretionary or one-time expenses you'd like to "add back" to your profit to calculate an accurate Seller's Discretionary Earnings (SDE).

Seller Interview: We’ll a set of detailed questions designed to help us understand how your business really operates, beyond the numbers. This insight allows us to highlight your company’s strengths, identify opportunities, and position it effectively for buyers.

Is the Business Valuation Process Confidential?

Yes, it's 100% confidential. We understand that privacy is paramount. Any reputable M&A advisor, including us, operates under a strict Non-Disclosure Agreement (NDA).

This legal protection ensures that your employees, customers, suppliers, and competitors will have no idea you are exploring your options. Your business operations can continue without a single disruption while you gain the clarity you need behind the scenes.

Understanding the true value of your business is the first step toward a successful and rewarding exit. It’s what removes fear and replaces it with confidence and a clear plan.

If you’re thinking about selling now or in the next few years, Carson Bomar & Matt Perkins at Exit Game Plan are here to provide clarity and confidence. We invite you to schedule a confidential, no-pressure consultation to discuss your unique situation and goals.

Comments