Small Business Market Wrap-Up: What the BizBuySell Annual 2025 Year-In-Review Means for Exits in 2026

- Carson Bomar - Business Broker

- 4 days ago

- 3 min read

As we roll into 2026, it’s a great time for business owners, advisors, and exit planners to take stock of how the small business transaction market performed in 2025, and what it signals for exits, valuations, and deal activity this year.

The BizBuySell annual 2025 Year in Review report paints a picture of stability, resilient fundamentals, and evolving buyer interest across the Main Street market. You can read the full blog here: Bizbuysell Year In Review

📊 BizBuySell Annual 2025 Year In Review Market Performance

According to BizBuySell’s 2025 Year-in-Review report, the small business transaction market remained stable with modest gains in pricing and cash flow. According to the review:

Total transaction value hit $7.95 billion, up ~3% compared with 2024.

Transaction count remained steady at roughly 9,586 deals, a modest 0.4% increase year-over-year.

Median sale prices climbed to $350,000 (+2%), while median cash flow and median revenue each increased by ~3%.

On average, businesses continued to sell at 94% of asking price, a sign of balanced negotiation dynamics.

➡️ Interpretation: These numbers tell us the broader U.S. small business market isn’t slowing, it’s settling into a sustainable pace where deals continue but sellers and buyers aren’t racing or retreating.

🧠 Key Sector Trends

Deal volume remains dominated by fundamental service-oriented businesses:

Top 5 sectors by transaction volume:

Service

Retail

Restaurants

Other categories

Manufacturing

Emerging buyer interest was particularly notable in:

Financial Services

Technology Services

Café & Coffee Retail

Beauty & Personal Care

These rising niches reflect where buyers are allocating attention and capital, especially growth sectors with recurring demand or lifestyle positioning.

📍 Where Buyer Interest Is Concentrated

Florida, California, and Texas topped buyer search activity, followed by Arizona and New York.

Most-searched business categories included:

Service

Restaurant & Food

Retail

Building & Construction

Automotive & Boat

This data provides valuable insight into which businesses are attracting buyers, useful for owners planning exits and advisors tailoring deal strategies.

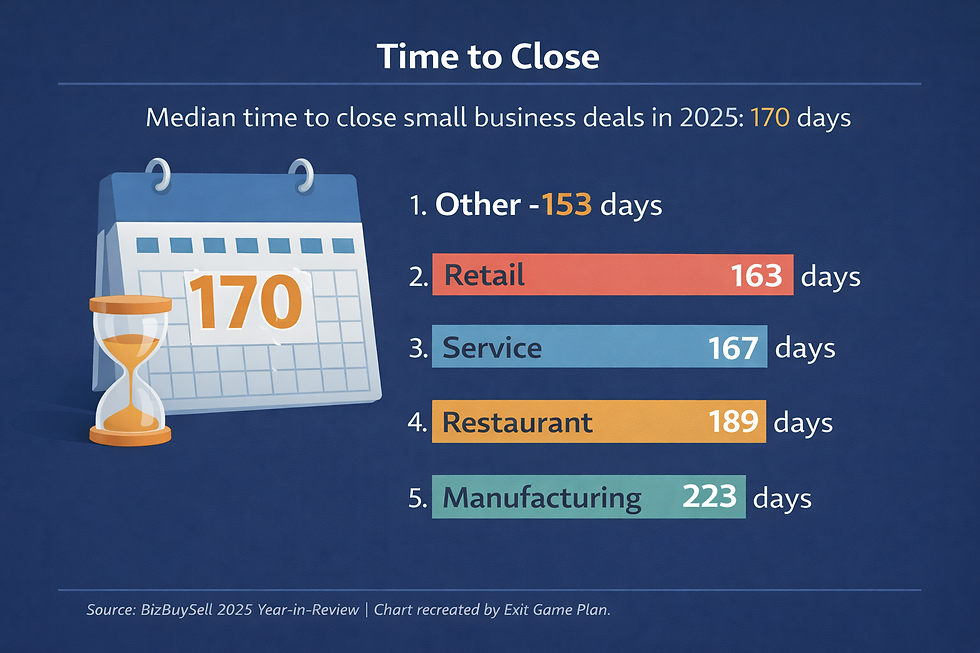

⏱ Time to Close Still Matters

Across all sectors, the median time to close a deal in 2025 was 170 days, with variation by industry:

Retail deals closed (≈163 days),

Manufacturing tended to take the longest (≈223 days).

Exit planning takeaway: Setting expectations for timeline, not just price, continues to be critical when preparing a business for sale.

How This Shapes Exit Strategy in 2026

Here’s what the 2025 review means for owners thinking about selling or planning their exit strategy this year:

🔹 Market fundamentals remain healthy. Strong cash flows and steady median prices make it a reasonable time to consider exit options.

🔹 Deal timelines are predictable. The median ~170-day close reflects a disciplined market where due diligence and buyer readiness are stable.

🔹 Sector trends can inform positioning. Buyers looking at services, tech, and niche retail signal sectors where strong multiples may emerge.

🔹 Location matters. Interest in states like Florida and Texas may boost market velocity for sellers in those geographies.

Final Thought

2025’s business‐for‐sale landscape wasn’t marked by dramatic growth, but healthy balance. For exit planners, that means opportunity with discipline: not every market upswing is required to create value, sometimes consistent performance and stable buyer interest are all you need.

If you’re preparing a business for transition in 2026, this snapshot offers a data-informed starting point for pricing, timing, and positioning your exit strategy.

Source Note: Market data referenced in this article is derived from BizBuySell’s 2025 Year-in-Review report and interpreted by Exit Game Plan for educational and strategic planning purposes.

About Exit Game Plan: Navigating the sale of your business is a complex journey, but you don't have to go it alone. The team of Carson Bomar, Matt Perkins, & Tom Brubaker the Co-Founders of Exit Game Plan are here to provide the clarity and expert guidance you need to achieve your goals.

If you're ready to explore your options, contact Carson Bomar & Matt Perkins, Co-Founders and Business Brokers at Exit Game Plan for a confidential, no-pressure conversation.

Comments